Exemplary Tips About How To Increase Your Credit Score Canada

Do not max out your credit cards & lines of credit 4.

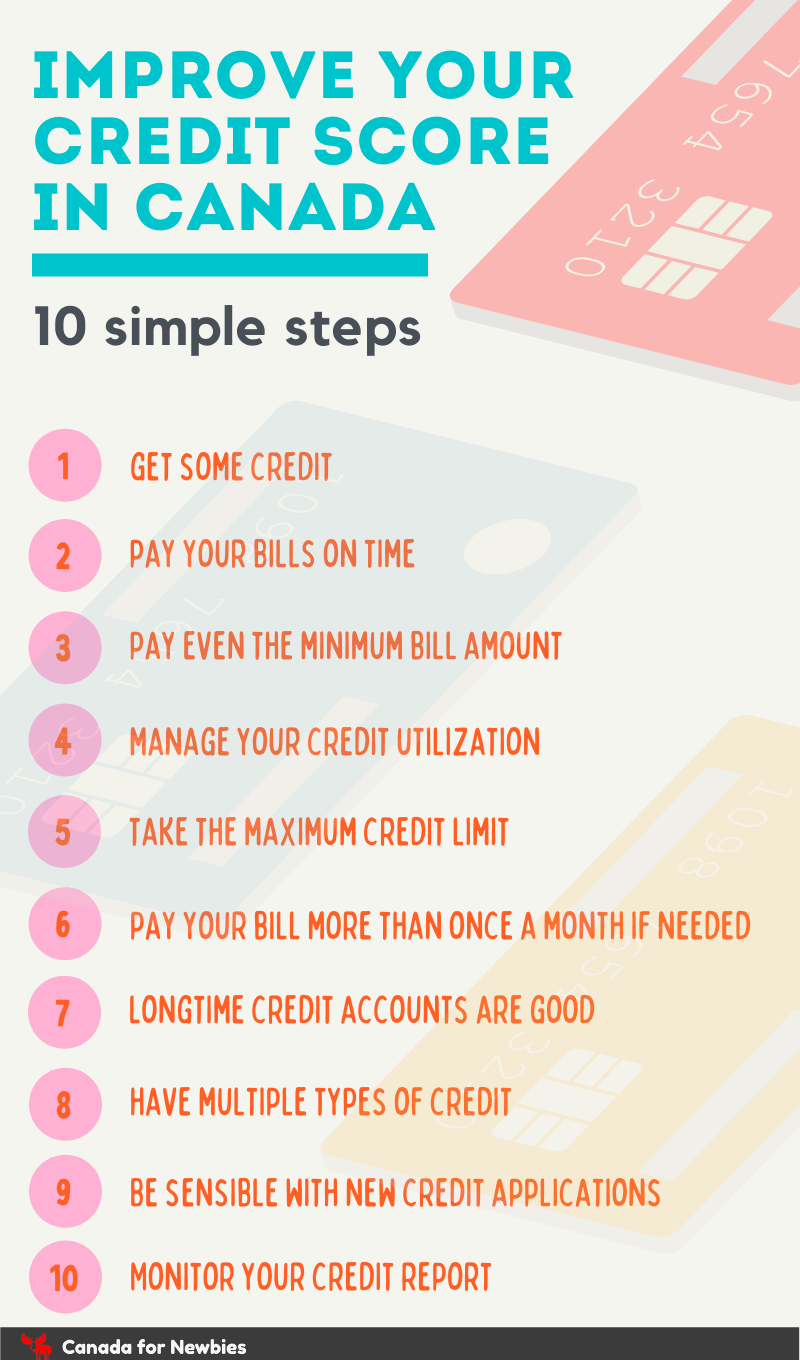

How to increase your credit score canada. There are a growing number of ways to boost your score. Learn how to get a better credit score by paying bills on time, keeping your credit utilization ratio low, and more. At the time of a 2018 study by equifax.

This way you get your most accurate score within minutes plus it includes your credit report and suggestions on how to improve your scores too. This is possibly the easiest way to help build your credit rating. It takes time to improve credit score, but learn.

This refers to the amount of credit you’ve. The number one thing you can do to improve your credit score is to pay your bills on time. Pay on time one of the best things you can do to improve your credit scores is to pay your debts on time.

Also, the impact of credit inquiry depends on hard or soft checks. It's better to have a mix of different types of credit, such as: Student credit cards there are a variety of student credit cards currently available that can help you build your credit history (while collecting rewards in some cases on your.

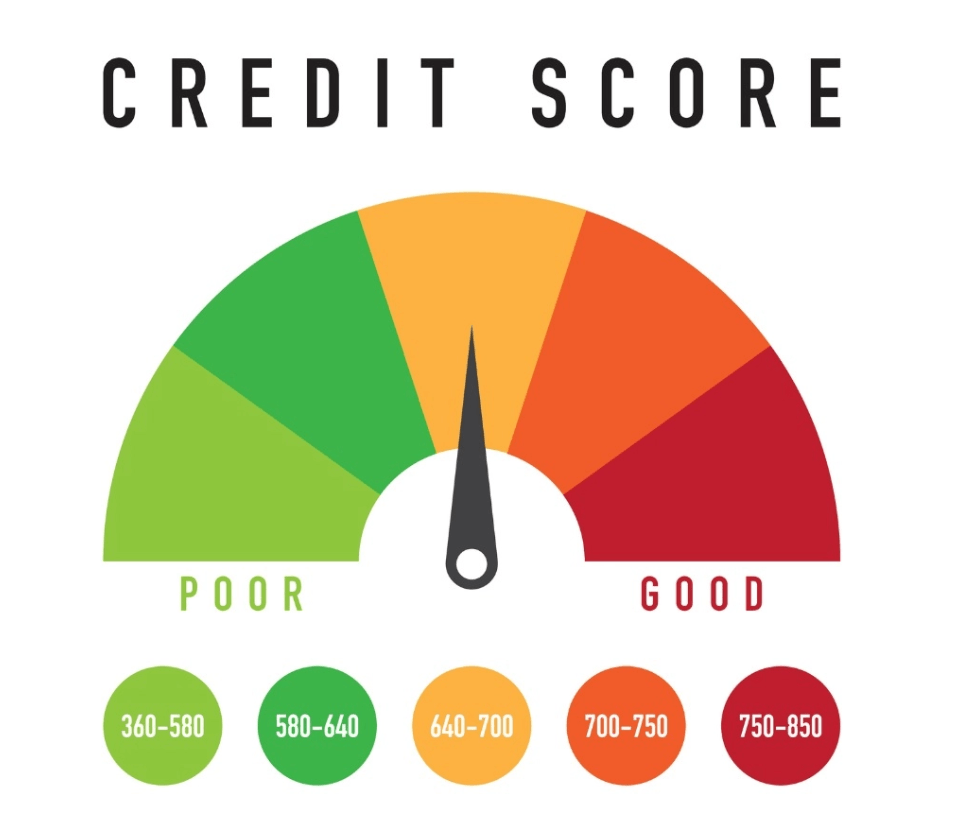

Here are the ranges experian defines as poor, fair, good, very good and exceptional. Young adults tend to have lower credit scores on average than older canadians. Want to improve your credit fast?

Factors that impact your credit score. To access these products: Secured credit cards, where a cash deposit is used as a backstop but otherwise work much like a regular credit card,.

Register on the electoral roll. Being on the electoral roll gives lenders proof that you are who you. A hard check affects your credit score while a soft check doesn’t.

Namibian dollar to canadian dollar. And remember, pay your bills. Once a year, you can request a free copy of your.

Open a koho account for free at koho.ca and download the mobile app. Payment history makes up a significant chunk of your credit. There are a multitude of ways canadians can improve their credit score, such as ensuring monthly bills are paid on time, maintaining a low debt / income ratio, and ensuring any.

Pay careful attention to your credit history so you know where you stand. If you have any outstanding bill payments, make those payments as. A line of credit a mix of credit products may improve your credit score.

![How To Increase Your Credit Score Canada [KOHO Credit building]](https://namso-gen.co/blog/wp-content/uploads/2021/12/How-To-Increase-Your-Credit-Score-Canada-KOHO-Credit-building-1024x576.jpg)

![5 Best Business Credit Cards for Low Credit Scores [2024]](https://upgradedpoints.com/wp-content/uploads/2021/02/Low-credit-scores.jpg)