Have A Tips About How To Fix Credit After Foreclosure

A foreclosure stays on your credit report for seven years from the first missed payment.

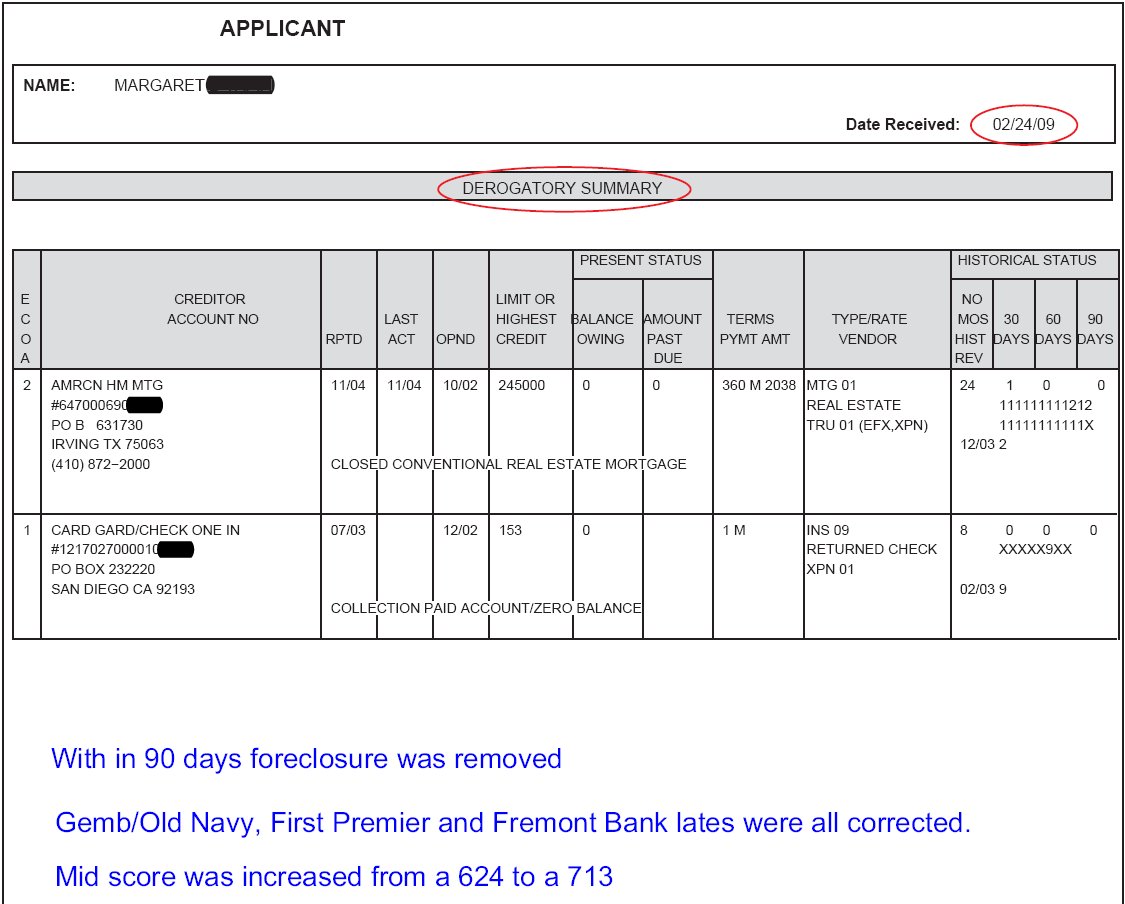

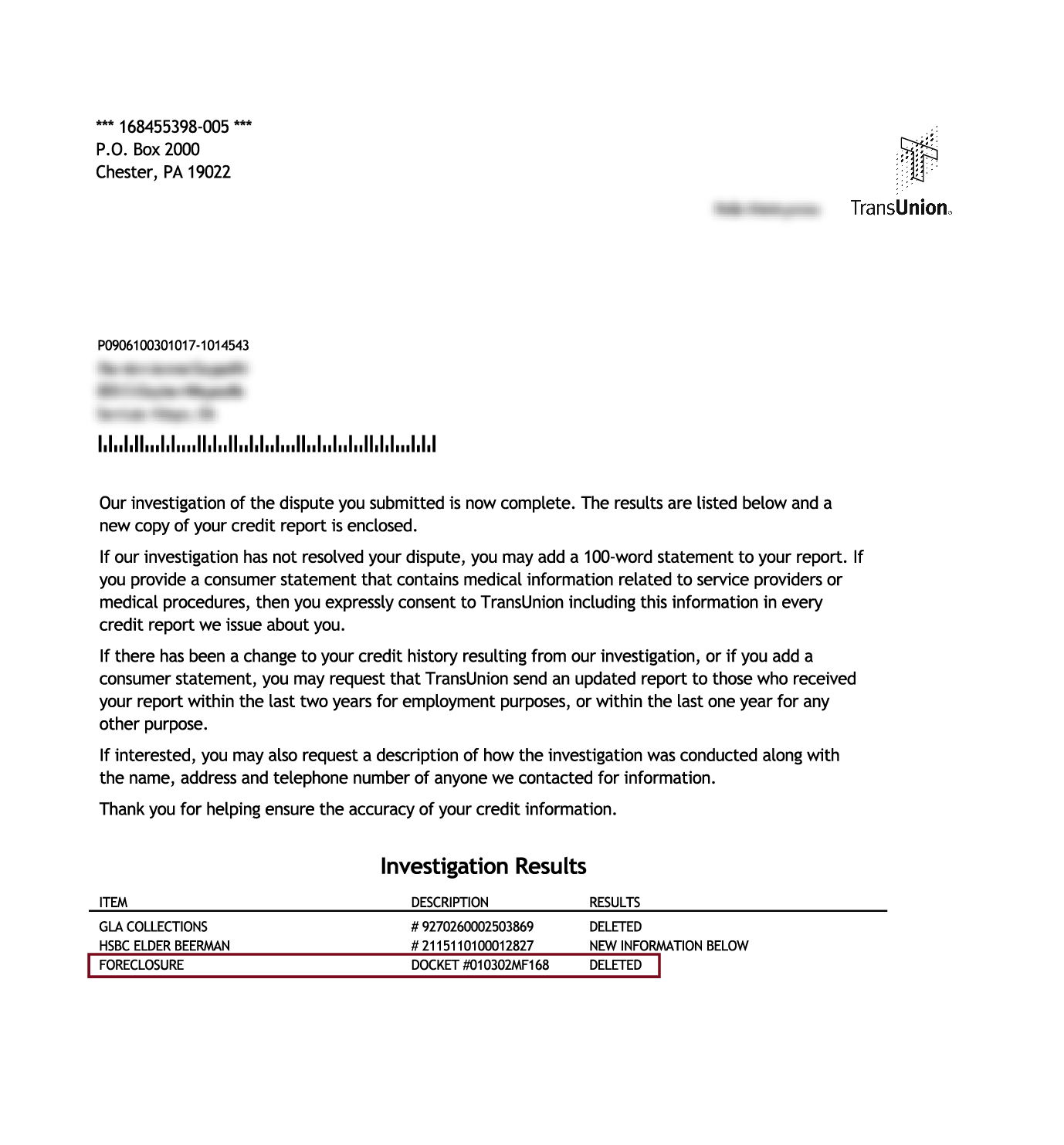

How to fix credit after foreclosure. October 5, 2021 4:51 pm thanks to changes in 2005 by the nation’s three major agencies, you will be able to remove a foreclosure from your credit files. A comprehensive guide no ratings yet let's face it, experiencing foreclosure can be a daunting and challenging phase in anyone's life. Here are three things you can do to start rebuilding your credit score with.

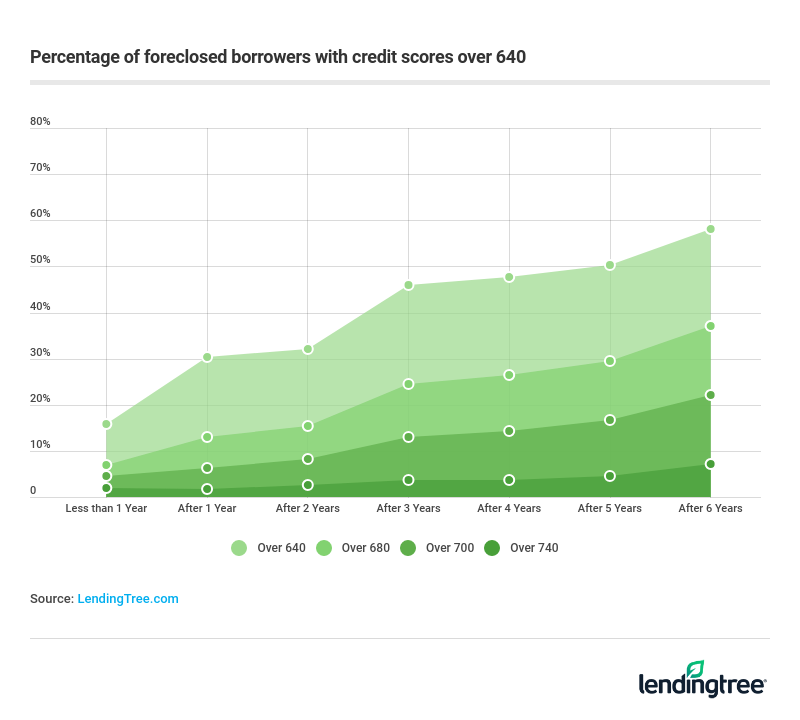

How long does it take to get your credit back after a mortgage foreclosure? A foreclosure may hang on your. There’s no way to spin it:

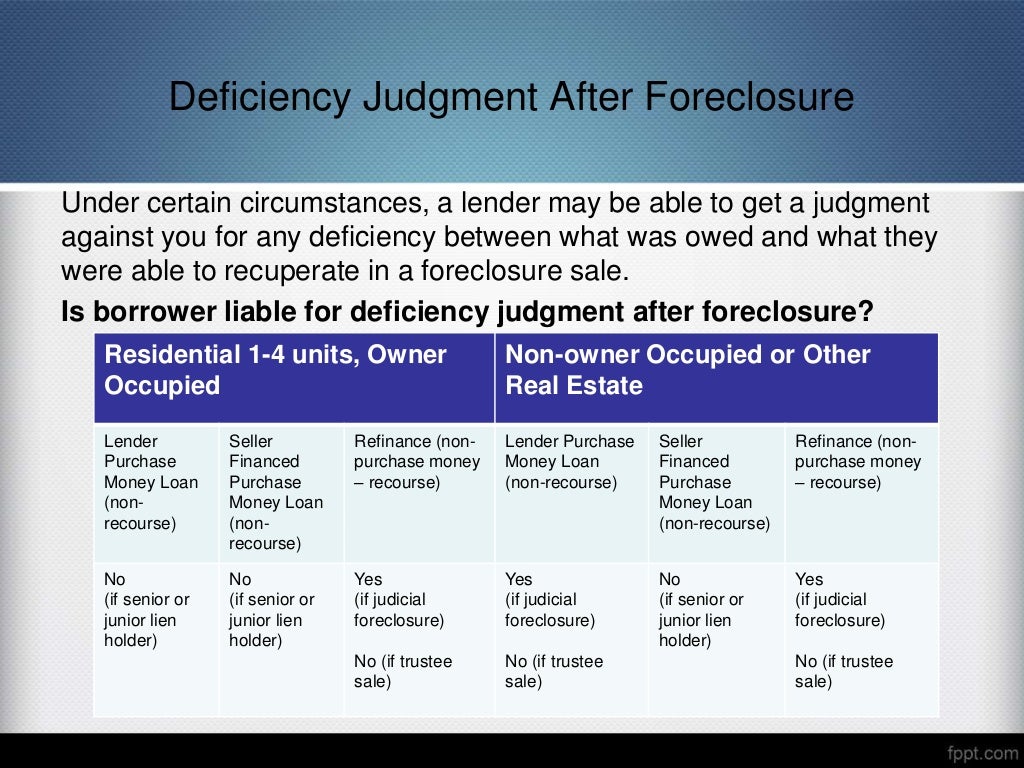

After a foreclosure, any of your existing credit card companies may decide to raise your interest rate. See how it affects your credit and how to recover. Ask for a deed in lieu of foreclosure.

You can do this by reducing. We will guide you through the process of removing this entry from your credit report.

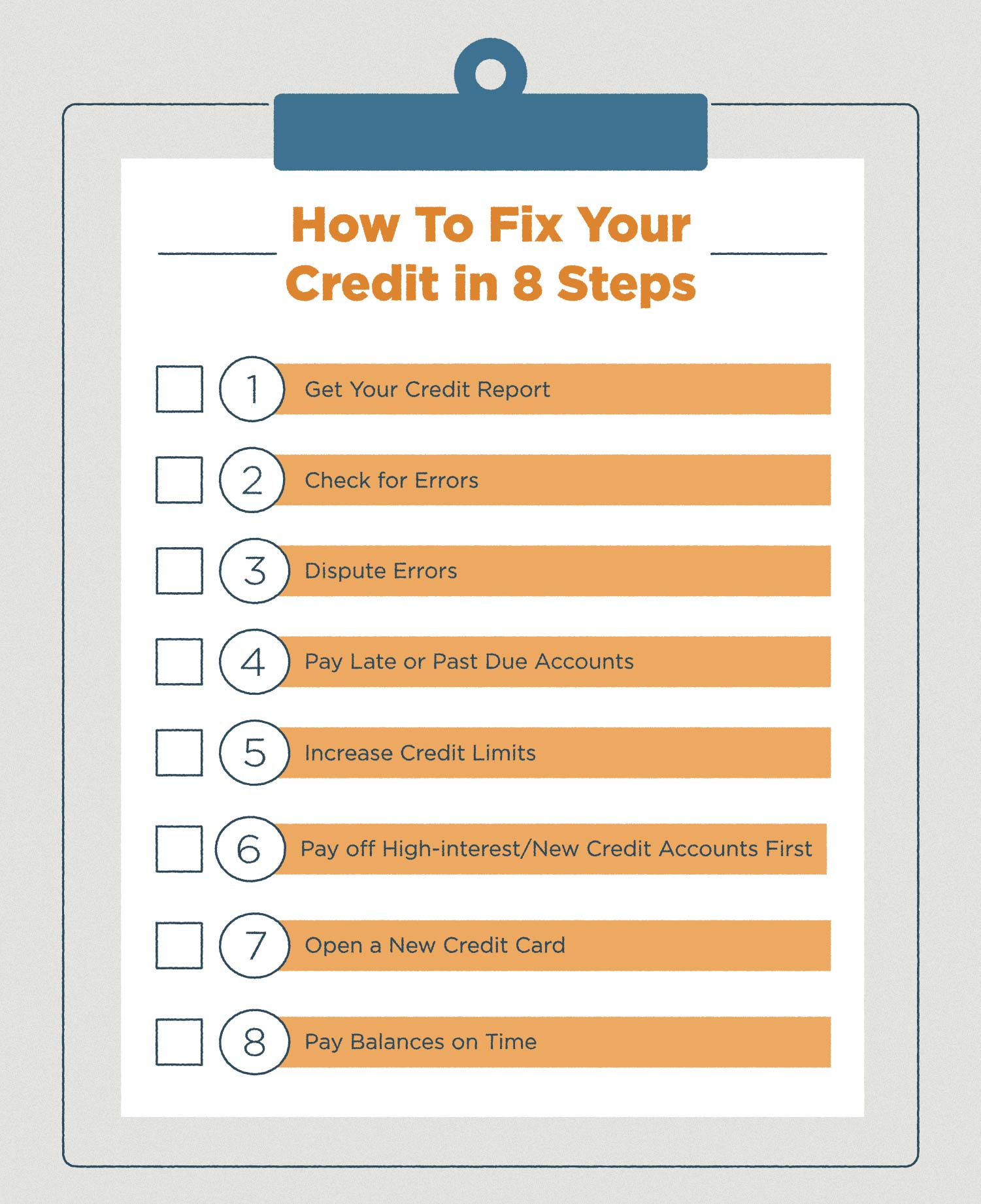

Consumers have the right to dispute information contained on credit reports. Monitoring your credit reports and scores, working on your payment history, lowering your credit utilization ratio, and considering a secured credit card are some. Credit repair after foreclosure:

But the good news is that you can improve your credit score and reduce the negative effects of the foreclosure on your credit history. Bankrate reports that your interest rate can increase to as. Rebuilding your credit after a foreclosure or eviction request and view your equifax credit report add or check the status of a security freeze and fraud/active duty alert submit or.

Fha loan borrowers who are struggling to keep up with their mortgage payments will soon have a new option to help them avoid losing. The drop in credit scores after a foreclosure varies from borrower to borrower. But, it doesn't signify the end for your credit.

To improve your credit after foreclosure, the first step is to request a copy of your credit report from each of the three major credit reporting bureaus: Timeshare foreclosure can harm your credit report and affect your credit scores. So how does a person recover their credit rating after experiencing a foreclosure?

Sell the house and call it even.