Supreme Info About How To Get A Loan Online

Before you apply for an online personal loan, you’ll want to get a sense of your credit score and.

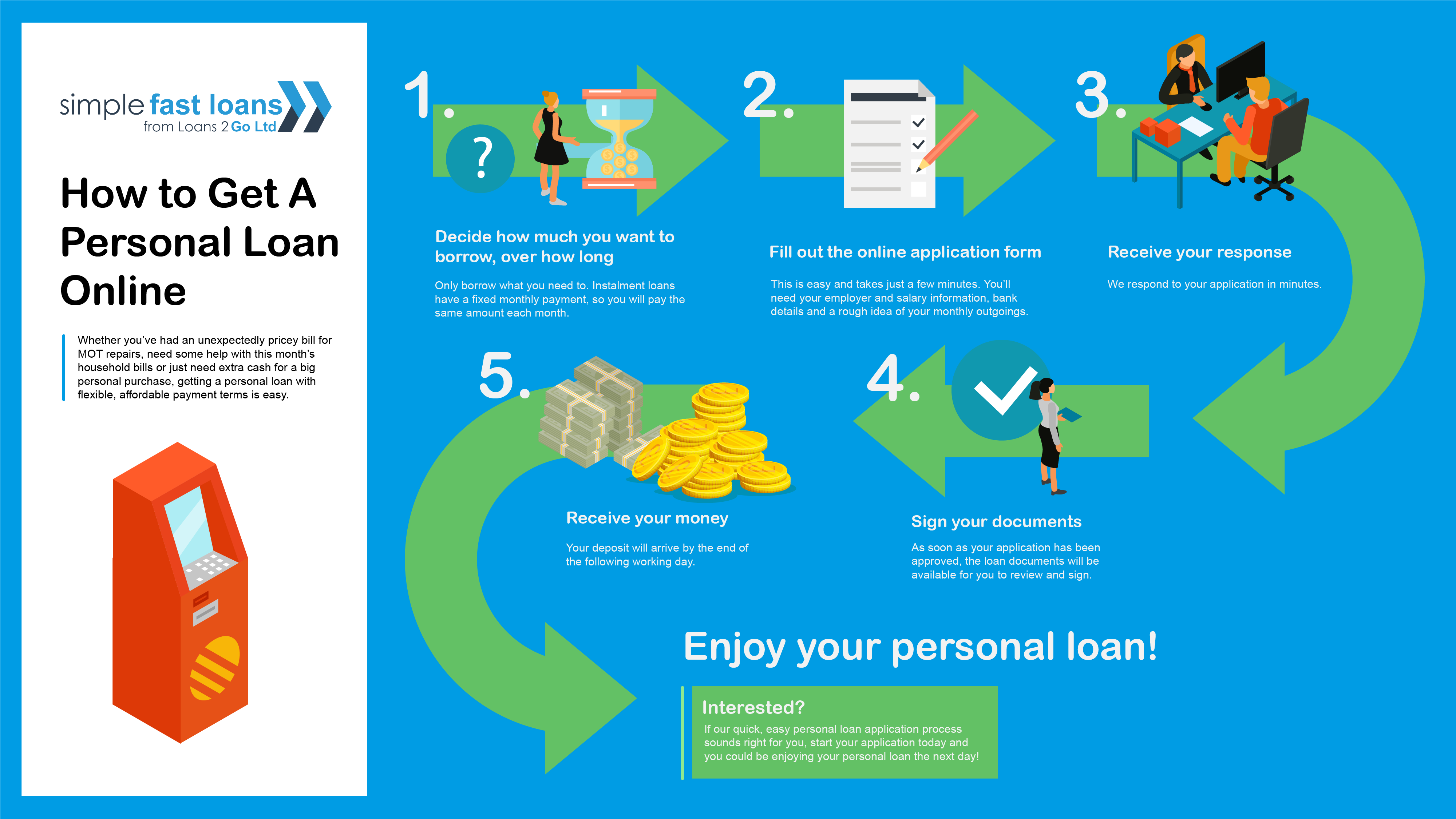

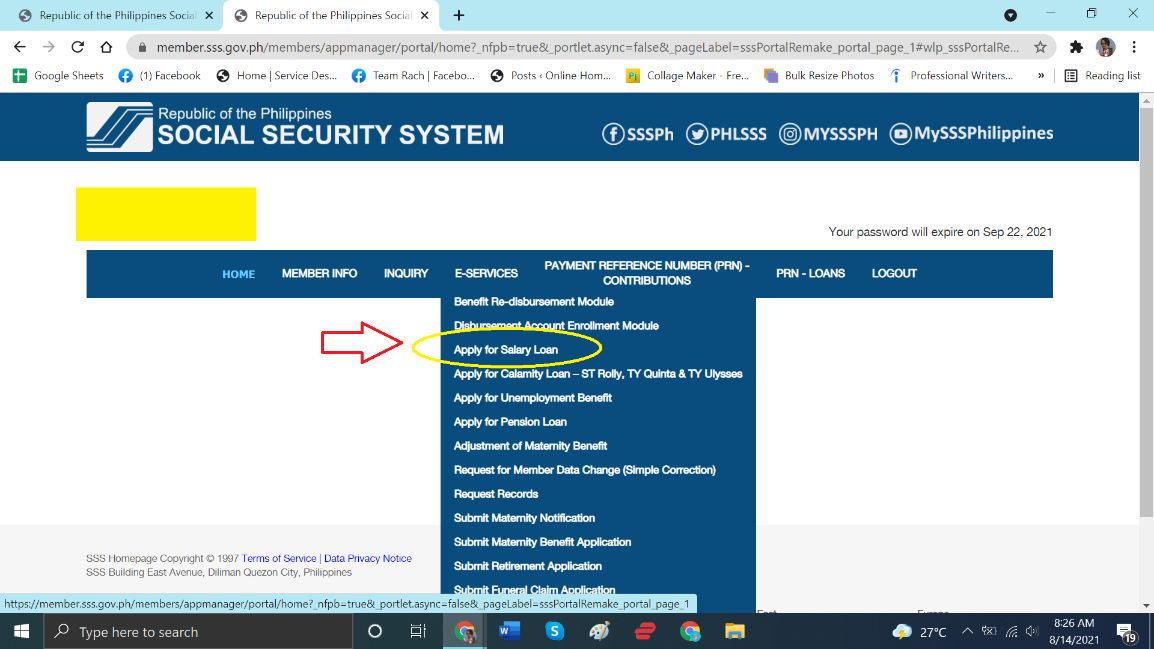

How to get a loan online. In most cases, lenders want to see at least a year or two in business and a regular income stream. Apply for prequalification step 4: How to get a personal loan online review your finances.

6 best payday lenders: Best online loans for excellent credit. Check your credit step 3:

Best fast small business loans. It’s also a tax situation that isn’t defined — h&r block can (and does) change what tax situations qualify for free at any time. Calculate your loan payments 3.

Checking your options won't affect your credit score. North american savings bank mortgage. By jackie veling and ronita.

You’ll sign a loan agreement, which can typically be done online without having to scan documents or go to a branch in person. Research and compare lenders 4. Best for small loan amounts:

To qualify for federal loans, you must be enrolled or accepted. The personal loans listed here are from reputable online lenders that check. Best for larger loan amounts:

Assess your budget step 2: H&r block’s online tax product is free only if you meet h&r block’s definition of a “simple return,” a tax situation that the ftc says many people think they have, but don’t. Best personal loans that offer an online application process.

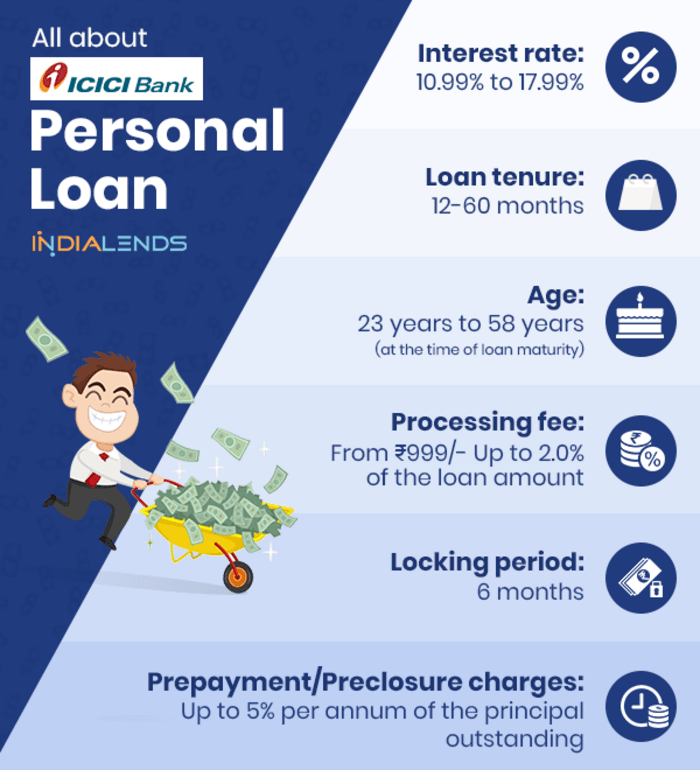

Personal loan from a bank or credit union banks or credit unions typically offer the lowest annual percentage rates, which represents the total cost of borrowing, for personal loans. Online loans are quick and easy, but the costs can. If you’ve been approved for a personal loan and you decide to accept the offer, then you’ll close on the loan.

You’ll pay back your advance when you get your next. Both factors lower the risk that you’ll default on a loan. Run the numbers before taking out a loan, decide exactly how much you need to borrow.

Close on your personal loan step 1: Get a small personal loan with instacash from moneylion. Assess your budget it’s a good idea to figure out how much you can afford to borrow before you take on new debt.