Real Tips About How To Buy Gold Commodities

First, here’s what to know about gold as an asset.

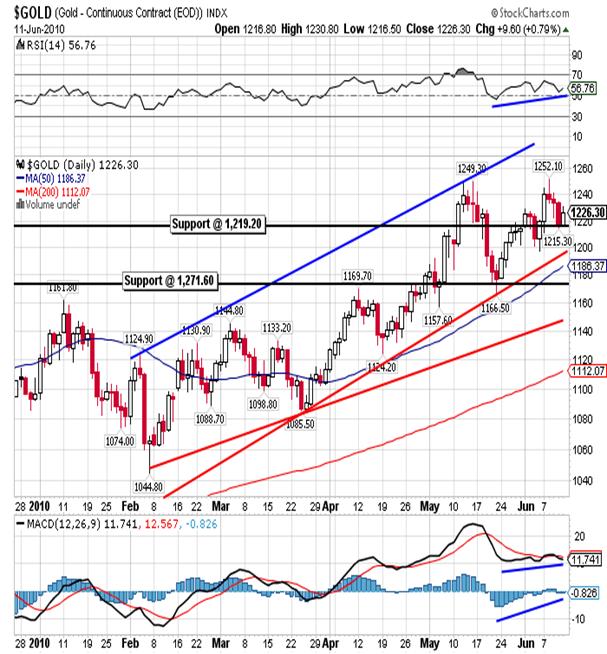

How to buy gold commodities. Before trading gold, traders should consider the following factors to create a personal trading strategy: Make a trading plan decide. Physical gold (aka bullion) or gold securities (stocks, funds, and futures).

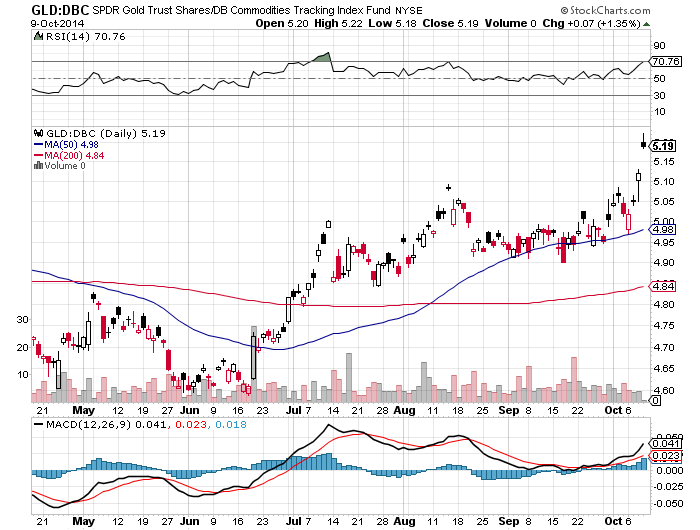

Many traders get carried away and take outsized positions in the metal. Physical ownership owning physical commodities mainly applies to. Gold exchange traded funds (etfs):

You can buy gold bars from dealers, individuals or online from sites like jmbullion, the american precious metals exchange (apmex) or sd bullion. Key takeaways investing in commodities can provide investors with diversification, a hedge against inflation, and excess positive returns. Select a gold market to trade choose between our gold markets or a selection of gold stocks and etfs.

Buying stocks in companies that. The american gold eagle, canadian maple leaf or south. Net central bank gold buying exceeded 1,000 tons two straight years, and commodity analysts at anz bank expect central bank gold demand to continue hot for.

There are a few ways to invest in gold in australia. It can be bought and sold using a. There is no risk of.

How to invest in commodities investors can access commodities in a few different ways. Closing prices for crude oil, gold and other commodities. Individuals have two main ways to invest in gold:

Gold is the most actively traded commodity in the world, accounting for around 15% of the global commodity market. Consider how much exposure you want to have. The five main ways to invest in commodities are:

Crude oil for april delivery rose $1.09 to $77.58 per barrel monday. Etfs buy and sell gold, or its futures, meaning investors. How to invest in physical gold

Some traders avoid physical gold because it’s easy to gain. Open an account. We’ll look at how to invest in gold for beginners in a moment.

You can sell items at any vendor in skull and bones. Gold etfs are akin to buying a certain quantity of gold without actually going to the trouble of physically owning it. Where to sell.